Performance Bonuses: A Motivator and a Payroll Challenge

In Malaysia performance bonuses have a big impact on employee motivation and recognition of great work. They boost morale and reward good results — but they also bring up a question HR teams tackle every year:

“How can we figure out bonuses when people start or leave mid-year?”

This is where prorated bonuses come into play. To be fair, companies adjust bonuses based on how long each employee worked during the bonus period.

In this guide, you’ll learn about:

- How performance and prorated bonuses work

- Whether companies must pay them

- How to figure out prorated bonuses

- How EPF, SOCSO, and PCB apply to bonuses

- How HRMS software simplifies the process

What Is a Performance Bonus?

A performance bonus is a cash reward that recognizes an employee’s work during a review period linked to goals or company results.

Unlike fixed pay, bonuses are optional — they depend on performance, company rules, or contract terms.

Examples of performance bonuses:

- Yearly performance bonuses

- Bonuses for finishing projects

- Sales or KPI-based rewards

What Is a Prorated Bonus?

A prorated bonus gives employees a portion of the yearly bonus if they didn’t work the full year — for instance, if they started midway or quit before bonus distribution.

A prorated bonus in Malaysia is a partial performance bonus that has a calculation based on the time an employee worked during the bonus period

This ensures fairness and consistency for all employees regardless of when they started or left.

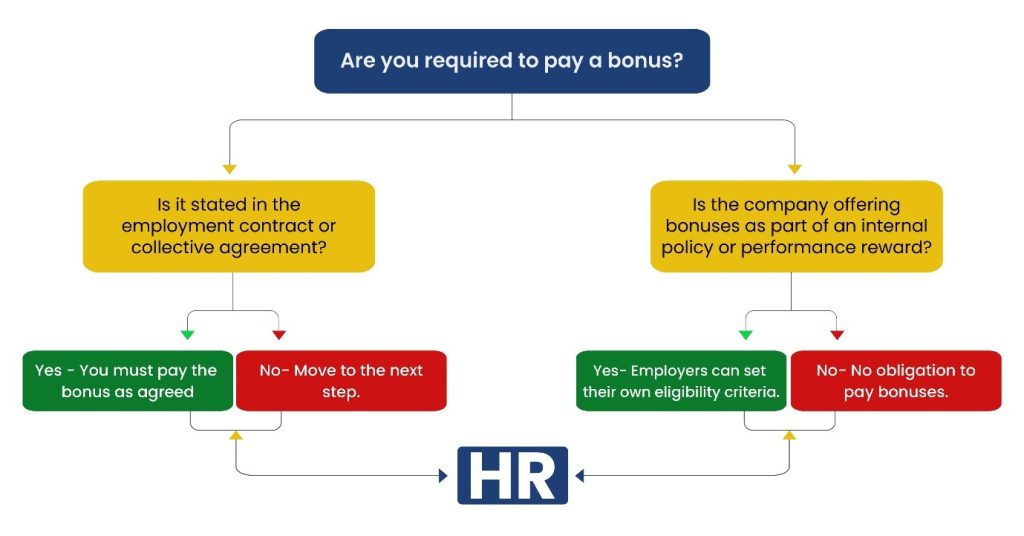

Do Malaysian Employers Have to Pay Bonuses?

No. Performance bonuses are not required under Malaysian law, unless:

- The employment contract or collective agreement says so, or

- The company’s internal policy makes this promise.

Companies decide:

- If new hires or probationers can get bonuses.

- If a minimum time of service is needed (like 6 or 12 months).

Even though the law doesn’t require them, bonuses are still a powerful way to increase retention and motivate employees — in fields with lots of competition.

How to Calculate Performance & Prorated Bonuses

In Malaysia, people often use two ways:

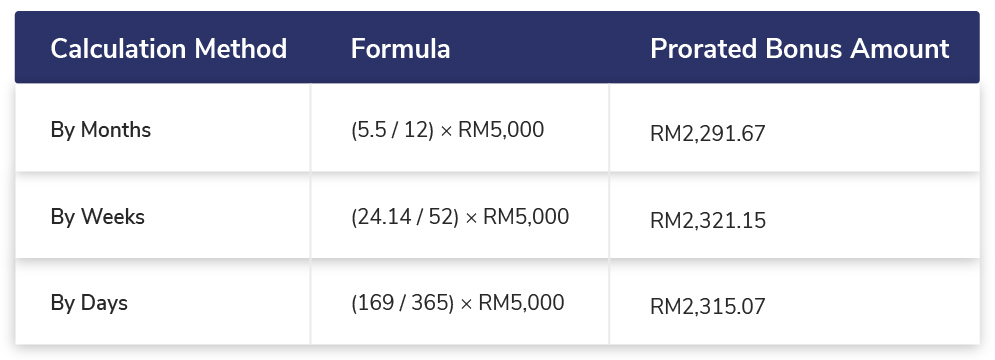

Method 1: Dividing by Months, Weeks, or Days

This way splits the whole bonus period by the time the employee was there.

Formula:

Prorated Bonus = (Months Worked ÷ Total Months in Bonus Period) × Full Bonus

Example:

Employee started: July 15, 2024

Bonus period: Jan 1 – Dec 31, 2024

Full-year bonus: RM5,000

Worked: ~5.5 months

Prorated Bonus:

(5.5 ÷ 12) × RM5,000 = RM2,292

Tip: You get more accurate results when you prorate by weeks or days instead of months, because months don’t all have the same number of days.

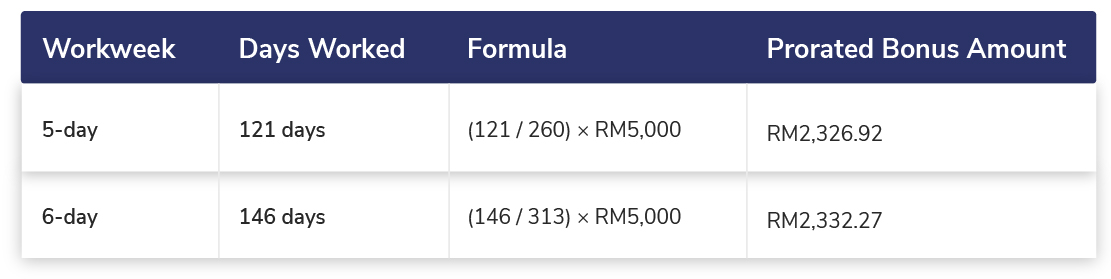

Method 2: Proration by Actual Workdays

This approach relies on total working days rather than calendar months.

Typical working days in Malaysia (2024):

- 5-day workweek → 260 days/year

- 6-day workweek → 313 days/year

Formula:

Prorated Bonus = (Days Worked ÷ Total Working Days in Bonus Period) × Full Bonus

This calculation produces the most precise figure as it takes into account weekends, holidays, and unpaid leave.

How to Handle Bonuses for Employees Who Leave

Companies often limit bonus payments to employees on the payroll when bonuses are distributed.

Still, some companies provide partial bonuses to employees who quit before bonus time, as a nice gesture. In these situations, HR applies the same prorated formula — worked out up to the employee’s final day on the job.

EPF, SOCSO & PCB Deductions on Bonuses

Performance and prorated bonuses fall under Additional Wages (AW) in Malaysian payroll rules.

This means they get taxed for:

- EPF (Employees Provident Fund)

- SOCSO (Social Security Organisation)

- EIS (Employment Insurance System)

- PCB (Potongan Cukai Bulanan / Monthly Tax Deduction)

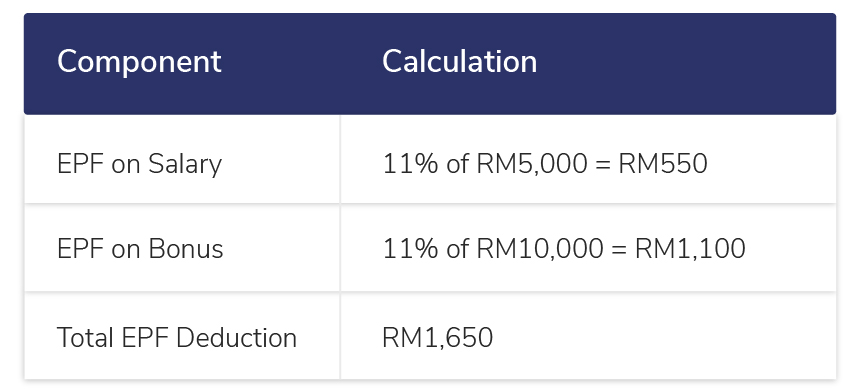

Example – EPF Deduction on Bonus:

Note: Always check EPF’s official contribution table to get the latest rates.

When you avoid these mistakes, you keep your employees’ trust and follow the rules.

How HRMS Software Makes Bonus Management Easy

Tracking prorations and deductions by hand takes a lot of time. Info-Tech’s HRMS & Payroll Software handles every step :

- Figures out performance and prorated bonuses on its own

- Updates EPF, SOCSO, and PCB rates without help

- Puts bonuses right into monthly pay stubs

- Creates payroll reports ready for audits

- Cuts down on mistakes and saves time each pay period

When bonus management goes digital, HR teams can put more effort into planning and keeping employees happy — not just dealing with spreadsheets.

Set Up a Free Demo to check out how Info-Tech ensures bonus processing stays accurate and follows the rules.

To Sum Up

Performance and prorated bonuses play a role in ensuring fairness motivating staff, and linking rewards to effort.

By learning how to calculate them — and by using HRMS tools to make the process automatic — your company can:

- Comply with EPF, SOCSO & PCB regulations

- Prevent payroll mistakes

- Keep staff content and driven

Simply put clever payroll = satisfied teams + correct compliance.

Frequently Asked Questions:

What does a prorated bonus mean?

A prorated bonus refers to a part of the performance bonus adjusted based on an employee’s duration of work during the bonus period.

Are employers required to pay bonuses?

No. Companies have discretion over performance bonuses unless contracts or collective agreements specify otherwise.

How do you calculate a prorated bonus?

Apply this formula: (Worked Months or Days ÷ Total Bonus Period) × Full Bonus Amount.

Are bonuses subject to EPF, SOCSO, and PCB deductions?

Yes. The law classifies all bonuses as Additional Wages (AW) making them subject to statutory deductions.

How can HRMS software help?

It has the ability to automate calculations, ensure EPF & PCB accuracy, and integrate bonuses into payroll processing.