Payroll Reports & Statutory Compliance

We ensure accurate preparation and delivery of payroll summaries, pay slips, and essential statutory documents like CP22, CP8D, CP58, and LHDN audit files.

| Problem | Solution |

|---|---|

| Lacked skilled manpower, not worth the cost to hire a dedicated payroll admin. | Skilled payroll outsourcing specialist handling company’s payroll and answering any payroll related questions |

| Multiple payrolls under different subcompanies that require different pay cycles | Pay cycle setup (mid pay & end pay every month) across different subcompanies |

| Employee shift rostering leading to complex payroll calculation | Integrated e-Attendance module and biometric scanner for automatic shift tracking |

Estimated Cost Savings

Estimated Time Savings

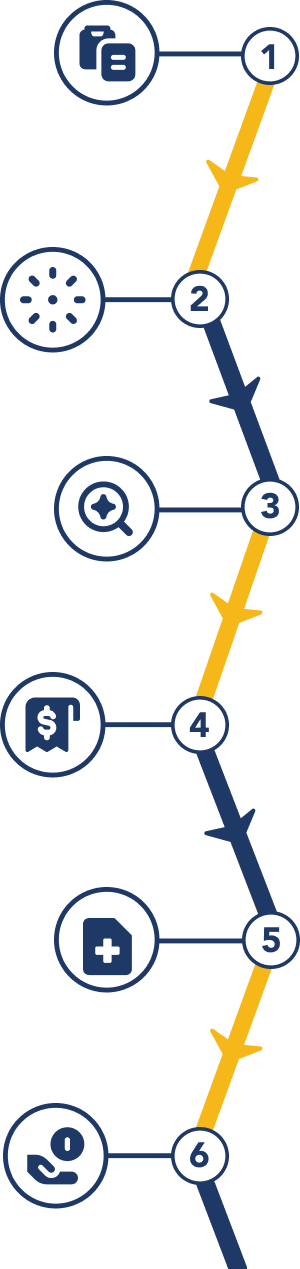

Serves as the main contact for personalized communication and service delivery.

Manages accurate and timely payroll processing, ensuring compliance and precise reporting.

Facilitates a smooth onboarding process, customizing the service to minimize disruptions.

Assists with technical aspects and training for efficient use of payroll software.

Payroll outsourcing involves contracting an external company or service provider to manage various payroll-related tasks for a business. Rather than handling payroll internally, businesses can delegate this function to specialized payroll service providers.

Payroll outsourcing involves assigning payroll tasks to an external provider such as Info-Tech. The process begins with a consultation to set up the service. Info-Tech will handle employee data, wage calculations, payroll processing, tax reporting, and compliance. We offer mobile app to access payslips and tax forms conveniently. Info-Tech’s locally-based support team will also assist with any payroll-related issues.

We need all the employee details to process payroll. We will have a kick-off meeting when you come onboard where we will brief you on all the operating procedures, timeline and others.