“Where’s my EA Form?” — The Question Everyone Asks in February

Have you heard this question echoing in your workplace (or maybe you’ve asked it yourself)? You’re not alone. Every February Malaysian employees scramble to find their EA Forms before tax season hits.

Still, many don’t grasp its real meaning—or the big problems that can occur if they get it wrong.

This guide explains all the key points employers and employees should know about EA Form 2025, including due dates typical errors, and how automating payroll can make following the rules a breeze.

What Is the EA Form (Malaysia)?

Its called Borang EA by LHDN (Lembaga Hasil Dalam Negeri), serves as a yearly income report that employers give to employees.

This document provides a breakdown of your earnings and deductions for the previous year (2024 for the 2025 filing).

It Contains:

- Base pay and extra hours

- Performance rewards and sales percentages

- Extra payments (for travel, food, etc.)

- Non-cash perks (company vehicle living space, etc.)

- Contributions to EPF, SOCSO, and EIS

- Tax taken out each month (PCB/MTD)

put, this form acts as your annual pay record—and forms the core of your personal income tax filing.

EA Form 2025 Timeline (Year of Assessment 2024)

|

Process |

Responsible Party |

Deadline |

|

EA Form Issuance |

Employer to Employee |

28 February 2025 |

|

Employer Form E Submission |

Employer to LHDN |

31 March 2025 |

|

Employee e-Filing Submission |

Individual |

30 April 2025 |

|

Sole Proprietor / Partnership Filing |

Business Owner |

30 June 2025 |

Tip: These dates don’t change much, but it’s a good idea to check LHDN’s official announcements for yearly updates or extensions.

The EA Form’s Significance

For employees, the form serves to file your yearly income tax. A missing or incorrect EA Form will lead to an inaccurate **tax causing you to miss refunds or face audits.

For employers, the form has a legal status under the Income Tax Act 1967. If you fail to issue it correctly or on time, you may face:

|

Offence |

Penalty |

|

Late or no EA Form issuance |

Fine of RM200–RM20,000 |

|

Inaccurate reporting |

Audit, backdated penalties |

|

Repeated non-compliance |

Legal prosecution, imprisonment up to 6 months |

Key takeaway: You must issue EA Forms—the law requires it.

Who Needs an EA Form?

Your employer has to give you an form if you’re an employee and your earnings go over the taxable limit. This applies to:

- Full-time employees

- Part-time staff

- Contract employees

- People who quit mid-year

Anyone who worked for even one month that was taxable

Each EA Form should be different and show the total money earned in the calendar year (Jan–Dec 2024).

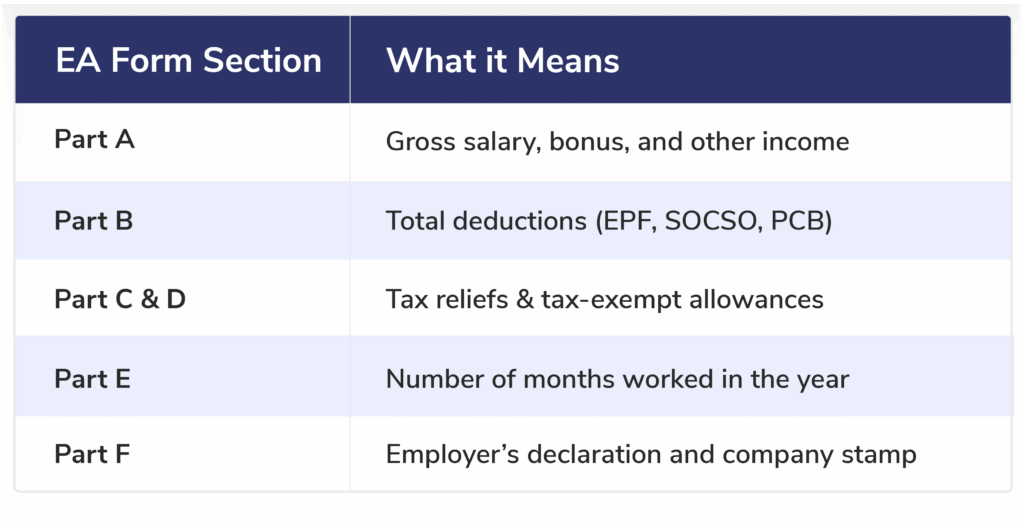

How to Read Your EA Form

Your EA Form has many parts, but here’s what you should look at:

Check that the numbers on your match your monthly pay statements or Info-Tech’s employee portal. If something’s off, bring it up with HR or the payroll team.

What Happens If Your EA Form Doesn’t Show Up?

If March comes and you still don’t have your EA Form:

- Ask for it in writing (through email or HR portal).

- Take it up with management if you don’t hear back.

- Tell LHDN if your employer doesn’t follow through.

Every employee has a legal right to get their EA Form.

For employers, not giving it out can lead to audits, fines, or enforcement.

How Info-Tech Makes EA Form Handling Easier

Doing EA Forms by hand—for big teams—is risky. Late papers wrong numbers, and lost files happen too often.

That’s why many Malaysian firms now count on Info-Tech’s Cloud Payroll Software, which:

- Creates EA Forms (CP8A-compliant) for each employee

- Works with Form E submission to LHDN

- Let’s employees get EA Forms through mobile app or portal

- Keeps forms safe in the cloud for future checks

- Meets all rules in the Income Tax Act 1967

Outcome: No need to print. No emails. No mistakes. Just quick correct compliance.

Common EA Form Errors Employers Make

|

Mistake |

Consequence |

|

Missing bonuses or allowances |

Underreporting income |

|

Excluding ex-employees |

Legal non-compliance |

|

Wrong EPF/SOCSO figures |

Inconsistent payroll records |

|

Manual editing errors |

Tax filing discrepancies |

|

Late submissions |

LHDN penalties and fines |

Check Out Next: Common Payroll Compliance Pitfalls

Employers’ 2025 EA Form Checklist

- Create EA Forms for every employee by 28 February 2025

- Verify salary EPF, and PCB info with payroll data

- Connect EA Form to Form E submission (due 31 March 2025)

- Save all copies to prepare for audits

- Let employees know when their forms are ready

Tip: Use Info-Tech’s payroll module to automate this process and make sure you don’t miss anything.

To Wrap Up

The EA Form isn’t just another tax paper — it’s key to following the rules for every business in Malaysia.

It helps employees file their taxes without stress. It keeps employers safe from fines, audits, and office mess.

Info-Tech’s HR & Payroll Software makes EA Form creation and tax submission easy — quick, precise, and LHDN-compliant.

Get in Touch With Info-Tech Now to automate your EA Form and payroll compliance for 2025.

Frequently Asked Questions:

What does the EA Form in Malaysia mean?

It’s a yearly income report employers must give employees to file income taxes.

When do employers need to give out the EA Form 2025?

Employers must provide it by 28 February 2025.

What if I don’t get my EA Form?

Get in touch with your employer or let LHDN know, since you have a legal right to receive this form.

Is it possible to create the EA Form online?

Yes. Payroll programs like Info-Tech’s HRMS can produce EA Forms that comply with LHDN rules.

Do former employees also get EA Forms?

Yes. Companies must give EA Forms to anyone who earned income subject to tax during the year.