“Wait — we forgot to stamp our new hire’s employment contract. Are we in trouble?”

If you’ve just brought a new employee on board and realized you didn’t stamp the contract, don’t worry.

Here’s the upside: companies in Malaysia have until December 31, 2025 to catch up. Under the Stamp Duty Exemption announced by LHDN (Inland Revenue Board of Malaysia), all employment contracts signed before January 1, 2025 have no stamp duty and won’t get penalties — if you stamp them before the grace period ends.

But this exemption window will close soon. Let’s go over what this rule means why it’s important, and what employers need to do now to comply.

What Is Stamp Duty for Employment Contracts?

Stamp duty in Malaysia is a RM10 tax required by law on employment contracts under the Stamp Act 1949.

While RM10 might seem small, the real problem comes from not following the rules.

If you don’t stamp a contract within 30 days after signing, you could face:

- A fine of RM50 to RM100 for each contract

- The contract being rejected in court

So, stamping isn’t just red tape — it protects both the employer and employee .

Employment contracts in Malaysia carry a stamp duty of RM10. The Stamp Act 1949 requires these contracts to be stamped within 30 days after signing. Contracts without stamps may face penalties and lose their legal standing.

What’s New: 2025 Stamp Duty Exemption Timeline

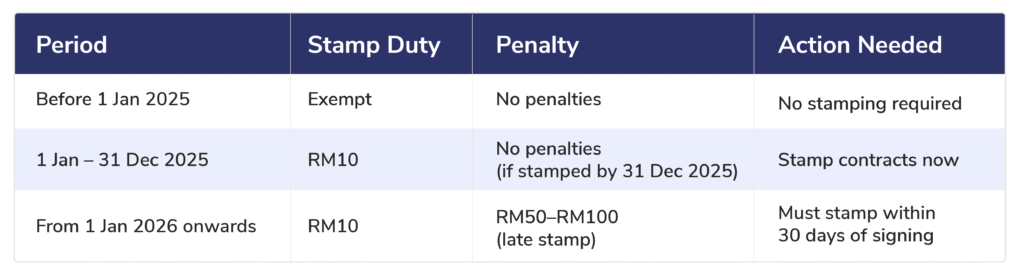

To ease companies into the new self-assessment system, LHDN has set up a grace period.

Here’s the official breakdown:

This exemption allows employers to update old contracts and get ready to stamp within 30 days starting 2026.

Why Employers Should Care

1. Courts Might Not Accept Unstamped Contracts

If your contracts lack stamps, they might not hold up as valid proof in arguments about pay, job endings, or bad behavior at work.

2. Fines Can Pile Up

While RM50 for each contract seems little, it builds up — 50 forgotten contracts = RM2,500–RM5,000 in penalties.

3. LHDN’s Do-It-Yourself Check System Begins Soon

Starting in 2026, companies will need to make sure they follow the rules themselves. You can expect more checks and tougher rule-following under this new plan.

Smart Move: Use this year’s free pass as your company’s “time to get everything in order.”

You can learn more about compliance risks and ways to steer clear of fines in our post on Common Payroll Compliance Pitfalls Malaysian Businesses Face.

What Employers Should Do Before 2025 Ends

Here’s a 3-step checklist to help HR teams get ready:

Step 1: Check Current Employment Contracts

Look through all contracts — digital and paper — and group them by when they were signed.

- Contracts signed before 1 Jan 2025 → Can get full exemption

- Contracts signed in 2025 → RM10 stamp fee, no penalty

- Contracts from 2026 onward → Need stamping within 30 days

If your HR team deals with lots of hires, use a digital HR system like Info-Tech’s E-HR System to keep track of contract records.

Step 2: Stamp Contracts Using LHDN’s STAMPS Portal

The STAMPS platform from LHDN handles the entire stamping process online.

Follow these steps:

1. Create an account or access your existing STAMPS profile

2. Submit your employment contract in PDF format

3. Make a payment of RM10 (when required)

4. Get your e-Stamp Certificate

This certificate serves as official stamping proof and should go into your digital HR records.

Step 3: Create a 30-Day Protocol to Start in 2026

From January 1, 2026, you’ll need to stamp within 30 days after signing.

Put together a clear Standard Operating Procedure (SOP):

- Include “stamp verification” in your employee onboarding checklist

- Set up automatic reminders in your HR system

- Store all e-Stamped contracts in your HR document archive

By making this a part of your process now, your HR team won’t be in a rush next year.

How HR Software Simplifies Compliance

Keeping track of stamp duty deadlines can become chaotic if you hire. This explains why many companies are moving to cloud-based HR solutions.

With Info-Tech’s HR & E-Invoicing Software, you can:

- Set up automatic alerts for contract stamping due dates

- Keep e-stamped contracts safe in a single hub

- Link contract signing to new employee onboarding

- Create compliance reports ready for audits in no time

Final Thoughts

Stamping employment contracts might look like a small job, but in legal terms, it carries significant weight.

The 2025 exemption gives Malaysian employers a unique chance to get up to speed, steer clear of fines, and align HR compliance before the new rules come into play in 2026.

Start auditing, stamping, and digitizing your contracts now rather than waiting until December. If you’re still managing files by hand, it’s high time to upgrade to a more intelligent HR system that takes care of compliance.

Book a Free Demo to check out how automation can help your HR team stay compliant.

Frequently Asked Questions:

How much stamp duty applies to employment contracts in Malaysia?

The Stamp Act 1949 sets it at RM10 for each contract.

Do I need to stamp contracts signed before January 2025?

Yes, but you don’t have to pay stamp duty or penalties if you stamp them by December 31, 2025.

What happens after 2025?

Starting January 1, 2026, you must stamp contracts within 30 days or you’ll face fines of RM50–RM100 for each contract.

Does this apply to foreign or part-time employees?

Yes. The stamp duty rule covers all employment contracts, no matter the job type or where the employee comes from.

Where can I stamp my contracts online?

You can do this on LHDN’s STAMPS portal. Upload your document, pay RM10 (if needed), and receive your e-stamp right away.