Tax time is back in Malaysia.

If you run a company, you know the pressure: due dates, tax paperwork fines if you’re behind.

If you’re a small company owner, self-employed worker, HR lead, or finance chief, you must follow the Inland Revenue Board of Malaysia (LHDN) rules. A late filing could result in thousands in penalties or even court action.

That’s why we’ve put together this 2025 Malaysia Income Tax Filing Guide for Companies — to help you understand:

- Which tax forms you need to fill out

- Important filing dates in 2025

- What happens if you miss the deadline

- How to streamline the process using digital tools

Let’s make your tax season easier!

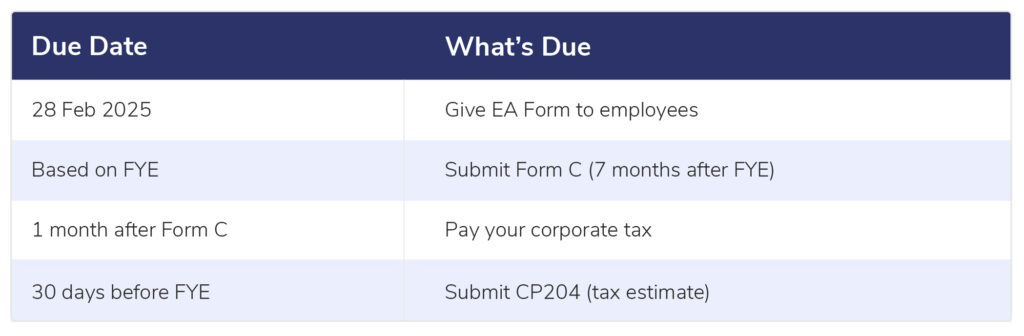

Important Malaysia Business Income Tax Filing Dates (2025)

Every company in Malaysia needs to pay and report corporate tax Your company’s tax submission deadline 2025 depends on when its financial year ends (FYE).

Here’s how it goes:

Form C (Corporate Tax Return):

Submit within 7 months after FYE

Tax Payment: Due within 8 months after FYE

Example: If your company’s FYE is 31 December 2024:

- Hand in Form C by 31 August 2025

- Pay tax by 30 September 2025

This rule affects all Sdn Bhd companies — even those without profits.

Important: If you don’t submit or pay on time, you might face fines or legal trouble.

- If you’re a sole proprietor, you’ll need to submit Form B to declare your personal and business income.

- If you’re running a partnership, your business must file Form P, and each partner must still submit their own Form B individually.

Freelancers gig workers, and online sellers must also report income to LHDN.

Tax Filing Forms for Businesses in Malaysia

Income tax submission involves giving LHDN details about your company’s income, expenses, and what you owe in taxes. This process uses specific forms now submitted online.

For companies in Malaysia, these forms play a key role in income tax submission,

- Form E (Employer Return)

Employers submit this to LHDN

It lists all employees’ salaries and PCB/MTD deductions

Deadline: 31 March 2025 (through e-Filing)

- EA Form (Employee Income Statement)

Employers give this to employees

It sums up yearly income and PCB deductions

Deadline: 28 February 2025

Employees use it to file their personal income tax

- Form C (Corporate Income Tax Return)

Companies (Sdn Bhd) file this as their main corporate return

Deadline: 7 months after FYE

It needs audited accounts, tax computations, and supporting schedules

- CP204 (Estimated Tax Payable)

CP204 shows your company’s estimated tax filing amount for the year. You submit this to LHDN to help them plan your monthly payments.

It must send the first CP204 30 days before your financial year begins

You make payments every month

These forms together help your company follow Malaysia’s Income Tax Act 1967

What Happens When You’re Late with Tax Filing?

Missing the deadline has serious results:

- 10% fine on tax you haven’t paid

- Another 5% fine if you still haven’t paid after 60 days

- Form C (late filing): Fine RM200 – RM20,000 or jail time

- Form E (late filing): Fine RM200 – RM20,000

Don’t take the chance of being late.

What Does Income Tax Filing Mean?

In basic terms, it’s the act of telling LHDN about your company’s earnings, costs, and tax obligations.

These days, this happens online through LHDN’s e-Filing platform, which needs businesses to submit the right forms by the deadline.

Without digital tracking, mistakes often occur—and fines follow.

How HRMS & Accounting Software Makes Income Tax Filing Easier

Are you still dealing with Excel sheets, emails, and paper forms when tax time comes? That’s how errors creep in.

With Info-Tech’s HRMS, Payroll & Accounting Software, companies can:

- Create EA Forms for employees

- Send Form E to LHDN with a single click

- Keep tabs on and handle CP204 payments

- Link payroll to PCB/MTD calculations

- Make audit-ready reports for Form C

- Receive alerts for every due date

This leads to full compliance and cuts down hours of manual work.

Malaysia Business Tax Filing Overview (2025)

Why Businesses Pick Info-Tech During Tax Season

Running a company can be tough—you don’t need to worry about meeting tax rules.

Info-Tech’s system offers you:

- Complete HRMS, Payroll & Tax platform

- Filing reminders to ensure you meet every deadline

- Reports ready for audits that satisfy LHDN

- Confidence that you follow Malaysian tax laws to the letter

Grow your business—we’ll take care of tax season worries.

Frequently Asked Questions:

What’s the corporate income tax due date in Malaysia (2025)?

Businesses must submit Form C within 7 months after their financial year ends and pay taxes within 8 months.

What forms must Malaysian employers submit to LHDN?

Malaysian employers need to submit Form E by March 31, 2025. They also have to give out EA Forms to their employees by February 28, 2025.

What is CP204 in Malaysia tax filing?

CP204 shows a company’s expected tax payment for the year. Companies must hand it in 30 days before their financial year ends. They pay this amount in monthly chunks.

What happens if Form C is filed late?

You might get hit with a fine ranging from RM200 to RM20,000 or end up in jail. On top of that, you’ll face extra charges on any taxes you haven’t paid yet.

How can HRMS software help with income tax compliance?

HRMS software has an impact on tax compliance in several ways. It automates EA & E submissions and links payroll with PCB. The software also keeps an eye on CP204 and makes sure you get timely reminders to meet every deadline.