Why Prorated Bonuses Matter for Malaysian Employers

Bonuses serve as one of the most effective tools to inspire employees and keep talented staff. But what happens when an employee starts mid-year, quits before bonus season, or works a short-term contract?

That’s where the prorated bonus comes in — a fair, time-based way to reward employees who didn’t work the full bonus cycle.

However, figuring it out by hand can be tricky when you need to follow EPF, SOCSO, and PCB (MTD) rules.

This guide will show you:

- What a prorated bonus means

- When you should use it

- How to figure it out (with examples)

- How taxes and PCB work with it

- How HRMS software can do the math for you

What Is a Prorated Bonus?

A prorated bonus is a partial bonus payment that companies give to employees who work for only part of the bonus period. This applies to employee who start or leave their jobs during the year.

The bonus calculation has its basis on the actual time of service within the company’s bonus cycle.

Example: Let’s say your company offers a yearly bonus of RM6,000. If an employee begins work in July, they’ve been with the company for half the year.

Prorated Bonus = (6 ÷ 12) × RM6,000 = RM3,000

This method ensures fair treatment. Employees receive rewards in proportion to their input, while companies can plan their finances .

When Should You Apply a Prorated Bonus?

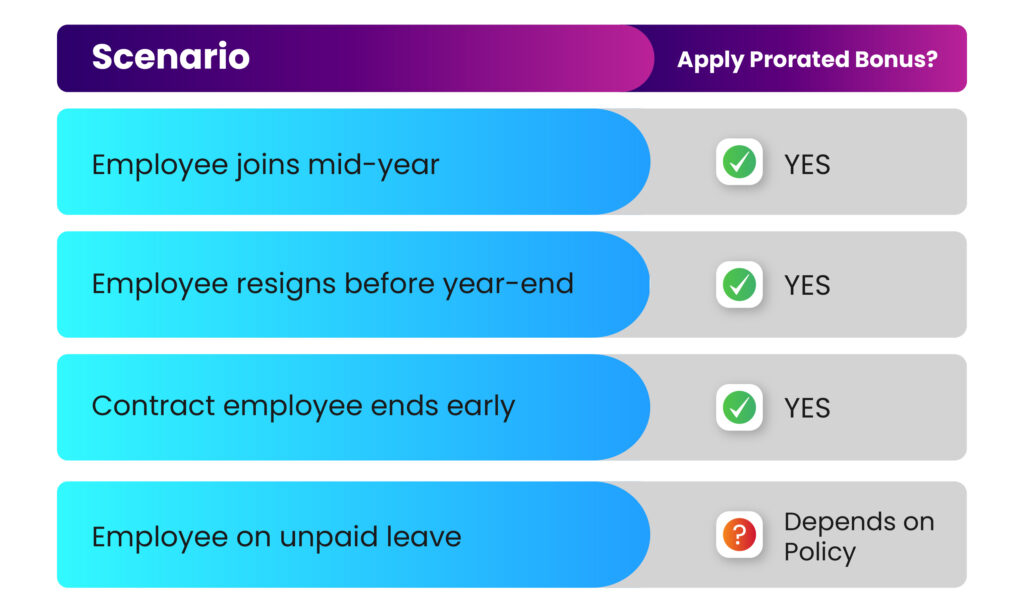

A lot of companies in Malaysia give out prorated bonuses for these situations:

Every company might do things — what matters is being fair and sticking to the rules.

To learn more about bonus types and policies, read our article on Understanding Performance Bonuses and Prorated Bonuses

How to Calculate Prorated Bonus (Formula + Example)

Here’s the math most people use:

Prorated Bonus = (Months You Worked ÷ Total Bonus Time) × Full Bonus

Example 1: Monthly Breakdown

|

Detail |

Value |

|

Annual Bonus |

RM6,000 |

|

Months Worked |

9 |

|

Total Period |

12 months |

|

Prorated Bonus |

(9 ÷ 12) × 6,000 = RM4,500 |

Example 2: Daily Basis (For Contract Employees)

Some companies use daily calculations for accuracy — for short-term employees.

Formula: (Days Worked ÷ 365) × Full Bonus

|

Detail |

Value |

|

Annual Bonus |

RM6,000 |

|

Days Worked |

180 |

|

Prorated Bonus |

(180 ÷ 365) × 6,000 = RM2,958.90 |

Helpful Hint: A daily calculation leads to more exact results — perfect for industries with high staff turnover or many contracts.

Days or Months: Which Calculation Works Best?

|

Basis |

Formula |

Best For |

|

Monthly |

(Months Worked ÷ 12) × Bonus |

Simple bonus policies |

|

Daily |

(Days Worked ÷ 365) × Bonus |

Contract staff or precision payroll |

Both ways work — what’s key is to stick to one method and clear communication in your company’s HR guidelines.

Does Malaysian Law Say You Must Give Prorated Bonuses?

Nope — bonuses aren’t required by the Employment Act 1955, unless your contract says so:

- An employment contract

- A collective agreement

- Or a company policy

But when a company includes bonuses in its terms, it must pay them as promised — including prorated bonuses where applicable.

Tip: Always include clear bonus terms in the employee handbook or contract and get employees to acknowledge them in writing.

Common Mistakes Employers Make

|

Mistake |

Result |

|

Ignoring start or resignation dates |

Overpayment or underpayment |

|

Using incomplete working months |

Inaccurate bonus computation |

|

Forgetting unpaid/no-pay leave |

Overstated bonus amount |

|

Manual Excel calculations |

High error risk, no audit trail |

|

Not clarifying proration policy |

Employee disputes & mistrust |

Even minor calculation errors can lead to employee unhappiness or tax reporting issues.

Are Bonuses Taxed in Malaysia?

Yes.

LHDN (Inland Revenue Board) rules state that bonuses count as taxable income and fall under the PCB (Potongan Cukai Bulanan) or Monthly Tax Deduction system.

Bonuses belong to the “Additional Wages (AW)” category, along with commissions and overtime pay.

Employers must take out:

- PCB (income tax)

- EPF (Employees Provident Fund)

- SOCSO (Social Security)

- EIS (Employment Insurance System)

If you’re getting ready for the 2026 e-Invoicing mandate, ensure your bonus calculations show up on payslips and income records for which Info Tech’s E-Invoicing Software would be the best option you can choose.

Also Check Out: PCB Deduction in Malaysia- Guide to Monthly Tax Deductions

Bonus Example with EPF and PCB

|

Component |

Amount (RM) |

|

Basic Salary |

5,000 |

|

Bonus |

10,000 |

|

Employee EPF (11%) |

1,650 |

|

Employer EPF (12%) |

1,800 |

|

Tax Deduction (PCB)* |

Based on LHDN rates |

This deduction helps your company follow Malaysian tax laws — and makes sure employees’ tax filings are correct at year-end.

How HRMS Software Makes Prorated Bonus Calculations Automatic

Using spreadsheets to handle prorated bonuses by hand can cause stress and lead to mistakes.

Info-Tech’s HRMS & Payroll Software makes everything easier by automating:

- Bonus calculations based on when people start or leave

- EPF, SOCSO, and PCB take-outs

- Creating payslips (with bonus details)

- Up-to-the-minute reports for HR and audits

Helpful hint: Info-Tech’s system also works with LHDN e-Filing and MyInvois (E-Invoicing) making sure your company follows all the rules before the 2026 e-invoicing requirement kicks in.

Book a Free Demo to see how automation keeps your payroll correct and worry-free.

Wrapping Up

Prorated bonuses do more than numbers — they show your company values fairness, openness, and professionalism.

When you handle them well, they help you:

- Give employees their fair share

- Steer clear of legal troubles

- Gain employee trust and keep them longer

By setting clear rules and using Info-Tech’s HRMS to automate things, you can process bonuses without mistakes, delays, or doubts.

Frequently Asked Questions:

What does a prorated bonus mean?

It’s a partial bonus paid to staff who worked for only part of the bonus period.

Is prorated bonus mandatory?

No, unless the employment contract or company policy says so.

How do I calculate a prorated bonus?

Use this formula: (Months or Days Worked ÷ Bonus Period) × Full Bonus Amount.

Are bonuses taxable in Malaysia?

Yes, bonuses have tax under PCB (MTD) and are subject to EPF, SOCSO, and EIS deductions.

Can HR software calculate prorated bonuses?

Yes, Info-Tech’s HRMS does this and combines deductions, payslips, and tax compliance.