A payslip stands as a basic payroll document, yet many people don’t understand it. Employees count on it to check their salary, cuts, and payments, while employers use it to show they follow Malaysian work and tax rules. If you want a free payslip template you can download, use, and fully understand – you’ve come to the right spot. This guide gives you a clear, useful payslip template and breaks down every component, why it’s there, and how to use it correctly in Malaysia.

Free Payslip Template (Sample)

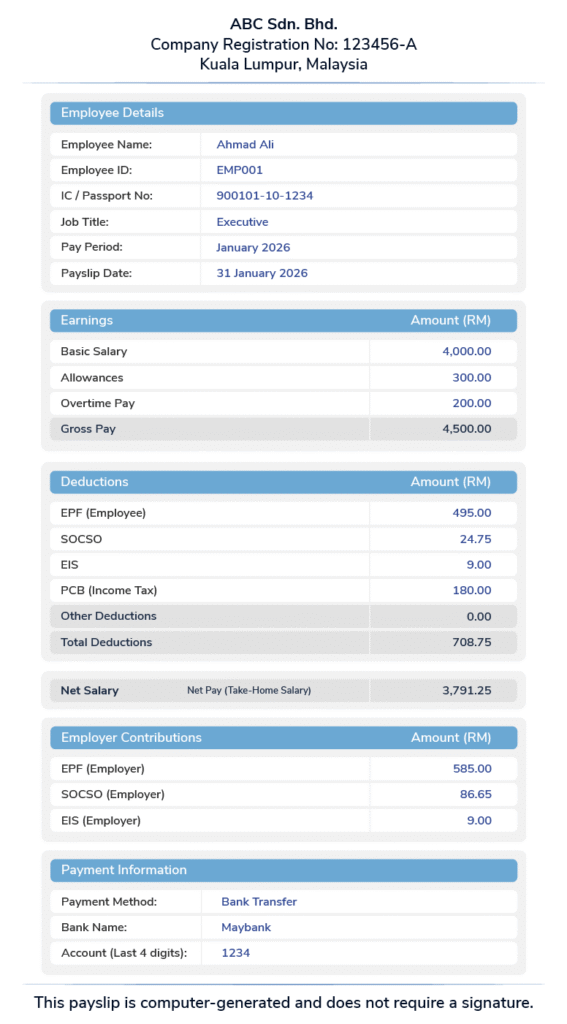

Here’s a typical payslip template that Malaysian employers often use. It suits -paid employee and matches usual payroll methods.

Payslip Template – Sample Format

This layout reflects what you’ll find on payslips created by payroll programs, spreadsheets, or online tools.

What Is a Payslip?

A payslip is a salary statement an employer gives an employee. It shows how they figured out the employee’s pay for a specific period. The payslip breaks down earnings, required deductions, and the final take-home pay. In Malaysia, the Employment Act doesn’t set a specific payslip format. However, employers should keep clear salary records and provide pay breakdowns when asked.

Why a Payslip Matters

Payslips have legal and practical uses. For employees, it helps check if:

- Salaries are paid

- EPF, SOCSO, EIS, and PCB deductions are correct

- Overtime and allowances are included properly

It helps employers to:

- Prove salary payments

- Show compliance during audits or disputes

- Reduce payroll misunderstandings and complaints

In many labour disputes, the payslip is the first document reviewed.

Breaking Down Each Part of a Payslip

1. Company Details

This shows who’s paying you. It’s good practice to include the company registration number to verify things during audits or for employees. Why it’s important: It proves the employer is legitimate and shows where the money comes from.

2. Employee Details

Lists the employee’s name, ID number, and employee code (when relevant). Why it counts: Prevents confusion in businesses with alike names or shared pay schedules.

3. Payment Period

The month or cycle the paycheck covers. Why it counts: Employees need to know which month their pay is for. particularly for bonuses, unpaid leave, or prorated pay.

4. Pay Breakdown

This shows how the employee’s total pay is made up. Common items include:

| Earnings Component | Explanation |

| Basic Salary | Fixed monthly salary |

| Allowances | Transport, housing, phone, etc. |

| Overtime | Payment for OT hours worked |

| Bonus / Incentives | Performance or contractual bonuses |

Why it matters: Being transparent about pay calculations helps prevent arguments over missing or wrong amounts.

5. Gross Pay

Gross pay means total earnings before deductions. Formula: Basic Salary + Allowances + Overtime + Other Earnings

6. Deductions Section

This part of is crucial.

| Deduction | Purpose |

| EPF | Retirement savings |

| SOCSO | Employment injury & social security |

| EIS | Unemployment insurance |

| PCB | Monthly income tax |

| Other Deductions | Loans, advances, unpaid leave |

Why it matters: Employees often look at this part first to ensure deductions match statutory rates.

7. Net Pay (Take-Home Pay)

Net pay is the real money an employee gets after deductions. Formula: Gross Pay – Total Deductions This amount goes straight into the employee’s bank account.

8. Employer Contributions

Shows what the employer pays for:

- EPF

- SOCSO

- EIS

Why it’s important: Though not taken from salary, this proves the employer is following the law.

9. Payment Method & Payslip Date

Tells how and when the company paid the salary. Why it’s important: Helps check bank records, show proof of payment, and employment verification.

What should a payslip include in Malaysia?

A Malaysian payslip needs to show employee details, pay period, earnings, deductions (EPF, SOCSO, EIS, PCB) net pay, and employer contributions.

How to Use a Free Payslip Template

You can use the template in:

- Excel or Google Sheets

- PDF format

- Online payslip generators

Basic steps:

- Put in employee and company info

- Add earnings

- Calculate deductions

- Check net pay

- Send out the payslip with salary

Templates work fine for small businesses or startups. As staff numbers grow, doing it by hand gets risky.

Is a Payslip Mandatory in Malaysia?

This is one of the most searched questions. Malaysian law doesn’t say you must print a payslip for every pay day, but employers need to keep salary records and show clear salary breakdowns when asked. In real life, it is considered standard and expected.

Common Payslip Mistakes to Avoid

- Missing EPF or PCB deductions

- Incorrect overtime calculation

- No pay period stated

- Net pay not matching bank transfer

- Employer contributions not shown

These errors often cause employee complaints or bring about compliance problems.

Final Thoughts

A free payslip template might look basic, but it has a huge impact on payroll transparency, employee trust, and legal compliance. If you’re an employer handing out salary or an employee checking one, knowing every aspect helps stop confusion and disputes. Begin with a straightforward template, get to know the components, and make sure it’s all correct — because when it comes to payroll, clarity always wins.

Frequently Asked Questions:

Does a payslip prove income?

Yes. Payslips are commonly used as proof of income for loans, rentals, and employment verification.

Do part-time employees receive payslips?

Yes. Every employee who gets paid should get a breakdown of their salary, no matter what type of job they have.

Can deductions be shown without explanation?

They shouldn’t. Each deduction needs a clear label to avoid confusion or disputes

Are bonuses required to appear on payslips?

Yes, bonuses paid through payroll should show up on the payslip for that pay period.