| Did you know? By mid-October 2024, over 7,400 Malaysian businesses had sent out 58 million e-invoices via the country’s pilot e-invoicing system. |

This figure continues to rise on a daily basis, and it is not only large corporations driving the trend, Small and medium enterprises (SMEs) are jumping on board too. They’re pushed by upcoming rules, business benefits, and the need to keep up with competitors.

If you’re running a business in Malaysia, e-invoicing isn’t just an extra— it’s essential.

What Is E-Invoicing?

E-invoicing (electronic invoicing) has an impact on the digital exchange of invoice data between businesses and tax authorities, in this case, Lembaga Hasil Dalam Negeri Malaysia (LHDN) through the MyInvois system.

Unlike PDFs or keyed invoices, e-invoices are structured data files.

Tax authorities verify them to make sure they comply with tax rules, and yes, you can’t “lose them in the mail.”

Why Does Malaysia Embrace E-Invoicing?

Malaysia’s push for invoicing is a key part of the Digital Economy Blueprint (MyDIGITAL). This plan aims to cut down on fraud, boost transparency, and bring business transactions up to date.

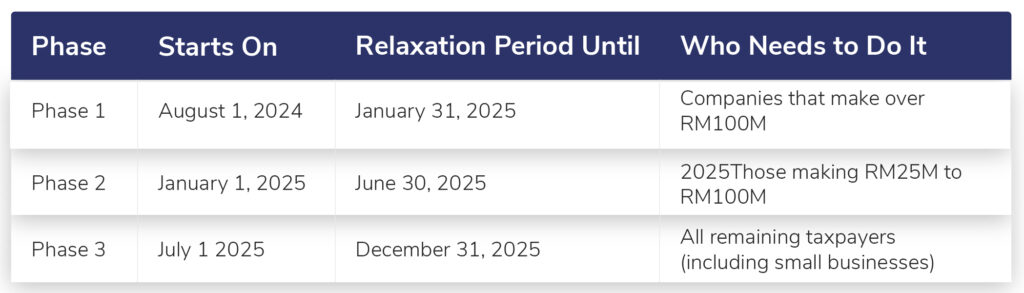

Malaysia’s E-Invoicing Rollout Timeline

LHDN is introducing this based on how much money a business makes:

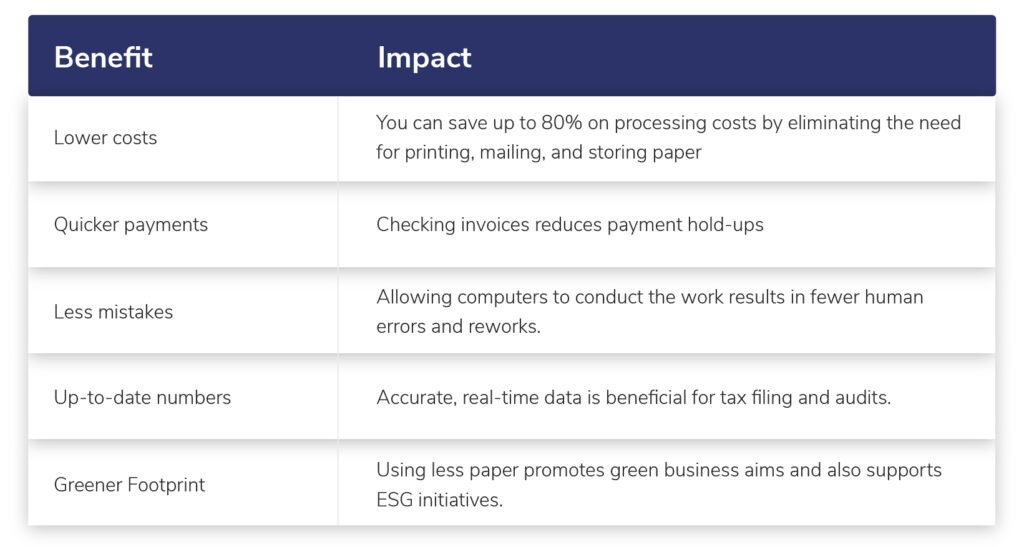

Why Companies Jump on E-Invoicing Early:

It provides more than just legal compliance like actual, demonstrable benefits.

How to Start with E-Invoicing in Malaysia

You can connect to the LHDN‘s MyInvois system in two different ways:

Direct API Integration (For Big Companies)

- This way is good for very large companies that have their own IT or software team.

- Your team will write computer code (called an API) to connect your company system directly to the MyInvois platform.

- It needs more time, technical knowledge, and setup.

Example: A big supermarket chain with its own software developers may choose this method.

Use a Peppol-Ready Solution Provider (PRSP) (Best for SMEs)

- This is the easiest and most popular option, especially for small and medium-sized businesses (SMEs).

- A PRSP is a certified company that already has the tools to connect to MyInvois.

- You don’t need to build anything. You just use their software — everything is ready and approved by LHDN.

Think of it like this: It’s like using a ride-hailing app (Grab) instead of buying and driving your own car.

Info-Tech’s E-Invoicing Software is a registered Peppol-Ready Solution Provider, which integrates with LHDN’s MyInvois platform. Our solution aims to make your compliance process easier, it doesn’t matter if you’re a retailer, manufacturer, or service provider.

Why Many SMEs Are Adopting E-Invoicing Early

Our clients’…

- Invoice processing time dropped by 30%

- See fewer disputes from mismatched entries

- Have better cash flow visibility across branches

And what matters most — they feel at ease, knowing their invoicing process complies 100% with LHDN rules.

Your Next Step!

If your yearly revenue tops RM25 million, you have just months until your deadline. Even as a smaller business, starting now gives you time to test, train your team, and launch with confidence.

Got More Questions? We Have Answers.

Read More On Our Blog:

- Guide to Navigate Through e-Invoicing in Malaysia

- Common Mistakes in E-Invoicing Implementation in Malaysia

Wrapping Up

This isn’t just a new rule — it’s a chance to set up your business for success down the road. With easy-to-use reliable tools like Info-Tech’s E-Invoicing Software, you don’t need to put this off.

Book a Demo with Info-Tech to make your switch to process smooth.

FAQs

- What’s e-invoicing and how does it work in Malaysia?

It involves the digital exchange of invoice data through LHDN’s MyInvois platform. It checks invoices in real-time, ensures tax compliance, and keeps records between businesses and tax authorities.

2. How can I get my business ready for e-invoicing?

Begin by checking your current invoicing setup training your finance staff, and picking a Peppol-Ready Solution Provider like Info-Tech. It’s crucial to link up with LHDN’s MyInvois portal.

3. Do small businesses or freelancers have to use e-invoicing?

Sure, by July 2025, all companies — big or small — need to follow LHDN’s e-invoicing rules. It’s smart to start to avoid problems at the last minute.

4. How does Info-Tech’s e-invoicing software help businesses?

Our tool meets LHDN standards, has Peppol certification, and is made for Malaysian companies. It cuts down on mistakes, sends submissions, and works well with current HRMS and accounting systems.