As of 1 August 2024, businesses with revenue of RM100 million per year have implemented e-invoicing into their operations. This is per the Inland Revenue Board of Malaysia’s plans for economic digitalisation. However, transition from traditional paper billing to e-invoicing can be confusing for businesses especially ones that have been in the market from a long time as they are used to traditional billing for decades.

What is E-Invoicing?

An e-invoice is a digital transactional record exchanged between a seller (supplier) and a purchaser (buyer). It is issued upon request and will run through government channels for validation and record-keeping.

Latest Updates from Malaysia e-Invoicing?

Extension of e-Invoicing Compliance Deadline by Six Months

- IRBM allows a period of relaxation for businesses to issue consolidated e-invoices for six months without facing any persecution for non-compliance. However, businesses that adopted e-invoicing within the stipulated original deadline will gain benefits in terms of a reduced capital allowance claim period for ICT equipment and software from three to two years for Assessment Years 2024 and 2025.

Why Should I Adopt E-Invoicing for My Business?

While there is a grace period of six months for compliance, the implementation of e-invoicing will be mandatory for all businesses by 1 July 2025. So if your business earns below RM100 million, you still have time to understand the e-invoicing system.

Read More: E-Invoicing: What Every Business Needs To Know By 2025

E-invoicing is meant to simplify tax filing for taxpayers, improve financial reporting and reduce human errors. In a way, it also saves you from any potential penalties or persecution that can be imposed by IRBM.

However, while businesses are mandated to issue e-invoices for all transactions, there are two key scenarios for business-to-consumer (B2C) transactions upon the implementation:

Scenario 1 – When Consumer Requires E-Invoice

If the consumer requests for an e-invoice, the business must obtain the required information, such as Taxpayer Identification Number (TIN), from the consumer. When the IRBM validates an e-invoice, it can serve as the consumer’s proof of spending for tax purposes.

To comply with e-invoice requirements and alleviate the burden on businesses and consumers, the IRBM permits businesses to combine transactions with consumers who do not require an e-invoice into a monthly consolidated e-invoice for IRBM validation, within seven (7) calendar days after the end of the month.

Scenario 2 – When Consumer Does Not Require E-Invoice

If the consumer doesn’t need an e-invoice, the business will provide a standard receipt or invoice. If the consumer decides they want an e-invoice, they can ask for one within the same month of the transaction.

Streamline Your Billing With Our Top-rated E-Invoicing Software

How Can I Stay Compliant To The E-Invoice System?

E-invoices are issued digitally and required for tax filing which falls under accounting. So, we recommend an accounting software to file the e-invoices and easily submit them to IRBM for validation.

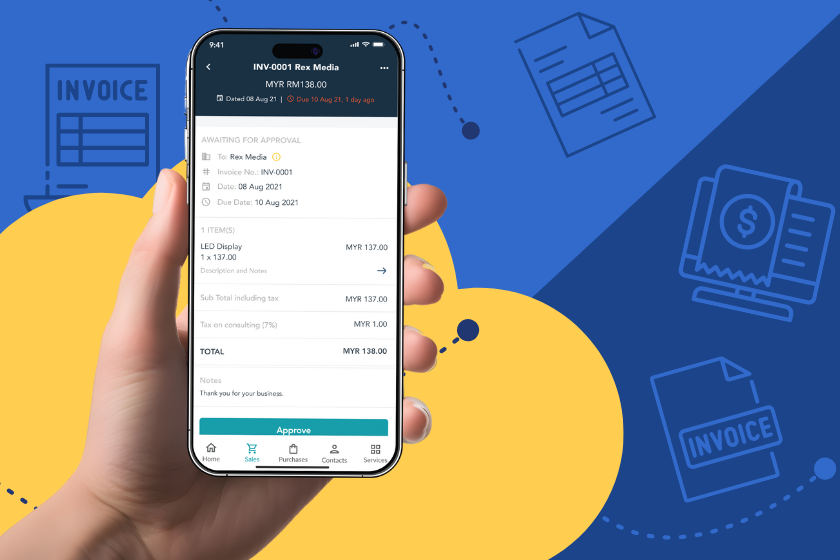

LHDN-ready accounting software from Info-Tech is the best choice for compliance with the e-invoicing system. Businesses can create invoices and save them in the cloud before issuing to consumers anytime or send to IRBM. A mobile app also makes it easy for businesses to issue e-invoices on the go. For more information, contact us at [email protected] or +603 6050 0333.