You might want to change from using spreadsheets for your payrolls to a software, but you’re too used with the traditional methods that you don’t think a software would have much use. However, there are many benefits of payroll software for businesses, especially small businesses like yours. Implementing a payroll management system may be just what you need. Using such a system saves much time you would otherwise spend on manual calculations and instead focuses on growing your business. Not only can this system save you time, but it can also reduce the risk of errors and increase accuracy.

Payroll software is essential for any organisation, regardless of size or industry. Ensuring that your employees are paid accurately and on time is crucial for their satisfaction and retention, and it can also impact your business’s financial health. This is where a payroll management system can be beneficial.

What is Payroll Software?

Simply put, it is a computed tool that helps with processing payrolls.

If you have a leave management system or attendance software, you can integrate them into the payroll software for immediate calculation, cutting down time and paperwork. It also calculates your taxes if you input the details, such as the type and percentage cut. The rest is up to the software to handle.

Payroll software allows you to generate your payslips, issue them to your employees and allow them to print out their payslips. It will remain accessible on their mobile or web browser if they work for your company.

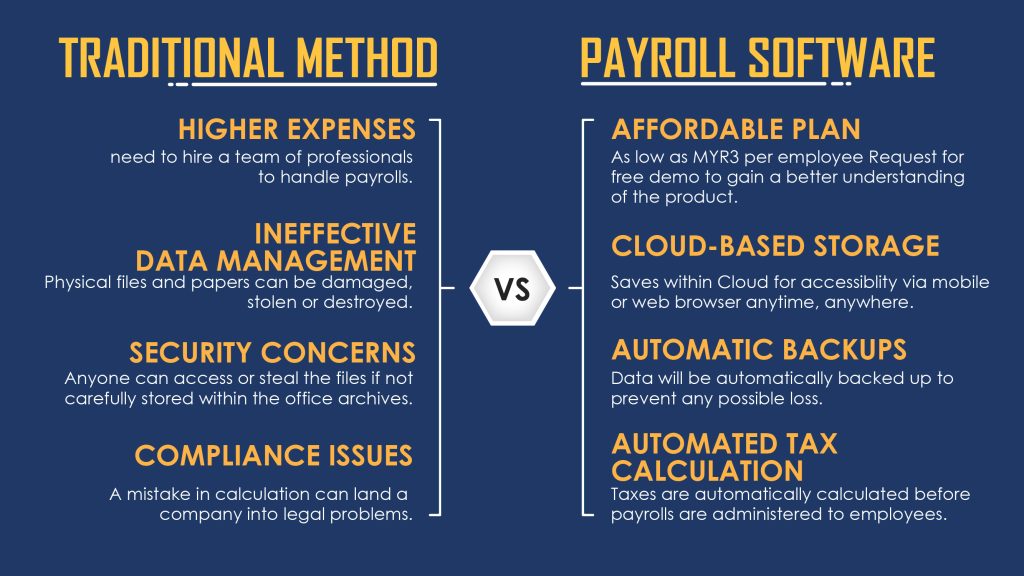

Traditional Method vs Payroll Software

Benefits of Payroll Software

A payroll management system is a software tool that aims to automate and simplify paying employees. Its features include calculating employee salaries, taxes, deductions, and benefits, managing employee time and attendance, generating payslips, and filing tax forms. So, what are the benefits of payroll software for your organisation? Let’s take a closer look.

1. Reduces Errors And Saves Time

Manual payroll processing can be time-consuming and prone to mistakes, leading to inaccurate employee payments and legal compliance issues. With a payroll management system, many tasks associated with payroll processing are automated, reducing the likelihood of errors and freeing up time for HR and Payroll staff to focus on other tasks.

2. Improves Compliance With Labor Laws And Regulations

The laws governing payroll and taxes are often complex and can change frequently, making it difficult for businesses to stay up to date. A payroll management system can automate compliance processes, ensuring that the organisation always complies with the latest legal requirements. This includes generating and filing tax forms, tracking employee hours and overtime, and ensuring employees are paid by minimum wage laws.

3. Enhances Data Security

A payroll management system provides secure storage and access controls to prevent unauthorised access to employee data. Additionally, many payroll management systems have advanced encryption and security features to protect against potential data breaches and cyber-attacks. This ensures peace of mind for employers and employees, who know their information is safe and secure.

4. Increases Employee Satisfaction And Retention

Errors or delays in payment can lead to employee dissatisfaction, ultimately affecting employee retention. However, a payroll management system can help ensure that employees are paid accurately and on time, increasing job satisfaction. Furthermore, most payroll management systems offer self-service options for employees to access their pay stubs, tax forms, and other payroll-related information. This can reduce the burden on HR and Payroll staff and give employees greater control over their payroll data.

5. Provides Real-Time Reporting And Analytics

The system can track employee time and attendance, generate reports on labour costs and productivity, and identify trends and patterns in payroll data. Real-time reporting and analytics enable organisations to make data-driven payroll and HR strategy decisions. It also helps identify areas for improvement and cost savings. In summary, a payroll management system provides accurate and up-to-date information that can help organisations manage their payroll more efficiently.

Calculation and numbers are not everyone’s favourite; let’s get that right. As small business owners, the first thing you want to do is to reduce as much cost as possible. If you hire a group of people just to process payrolls, imagine how much you need to spend to hire and train them when they are on board, not to mention the possibilities of errors happening during calculations and administering payrolls, which would be too much for you who are just starting!

With payroll software, everything is automated! Integrate the leave and attendance data with the payroll, input the tax deduction percentage, and make all the calculations at your fingertips.

Using software saves you tremendous money on hiring and training a payroll team. This will enable you to redirect those resources to other vital areas of your small business.

Best Payroll Software Provider in Malaysia for Small Businesses

Info-Tech Provides The Best Payroll Software For Small Businesses In Malaysia.

Our software lets you access our cloud system to store and manage your employees’ payroll data. If you purchase our leave and attendance software, you can immediately integrate it into the payroll software for automatic calculations.

Contact us via email at [email protected] or call us at +603 6050 0333. You can ask us about its features to see if they are compatible with your business.