Monthly tax deduction required for employees earning above the taxable limit. It's worked out based on income, marriage status, and dependent claims.

Do you need a quick and trustworthy method to work out your employee's monthly deductions in 2026? Are you an HR manager, business owner, payroll executive or even an employee trying to understand your take-home pay? Info-Tech's Free PCB Calculator makes payroll calculations simple and worry-free.

From EPF, SOCSO, and EIS to PCB (Potongan Cukai Bulanan), our payroll calculator aims to help Malaysian companies comply with the latest LHDN and PERKESO contribution rates.

PCB Calculator (2026 Version)

* Please note that this calculator is provided for personal reference only and should not be used as an

official source for statutory submissions.

For accurate calculations and compliance, kindly consult

with payroll professionals or the relevant statutory bodies

How To Use This PCB Calculator?

Step 4: Let the calculator do the math – view monthly deductions instantly.

Need to calculate only the "Bonus PCB" ? No problem. Just enter the monthly salary and enter the bonus in the "Additional Income" box. The calculator will display the total PCB, and you can work out the tax on just the bonus by taking away the regular monthly PCB.

Components Mean?

A retirement savings plan where the employer and the employee both contribute. As of 2026, the law says employees put in 11% and employers 13% (for pay under RM5,000).

Covers employees under the Employment Injury Scheme and Invalidity Scheme. It's a must for all Malaysian employees earning less than RM5,000.

Helps retrenched employees find new jobs and get some money for a while. The cost is split down the middle between the employer and the employee.

Why Pick Info-Tech Payroll Tools?

If you need a quick PCB estimate, our calculator works great. But if you want to

boost your payroll capabilities, Info-Tech's HR &

Payroll Software is the

way to go.

Create EA Forms and PCB 2 without effort

Include non-taxable allowances without changing PCB or EPF (like mileage)

Manage bonus - tax math with ease

Sync in real-time with LHDN and PERKESO formats

Run unlimited payrolls and keep digital payslips safe

Join thousands of Malaysian companies already making their HR & Payroll easier with Info-Tech.

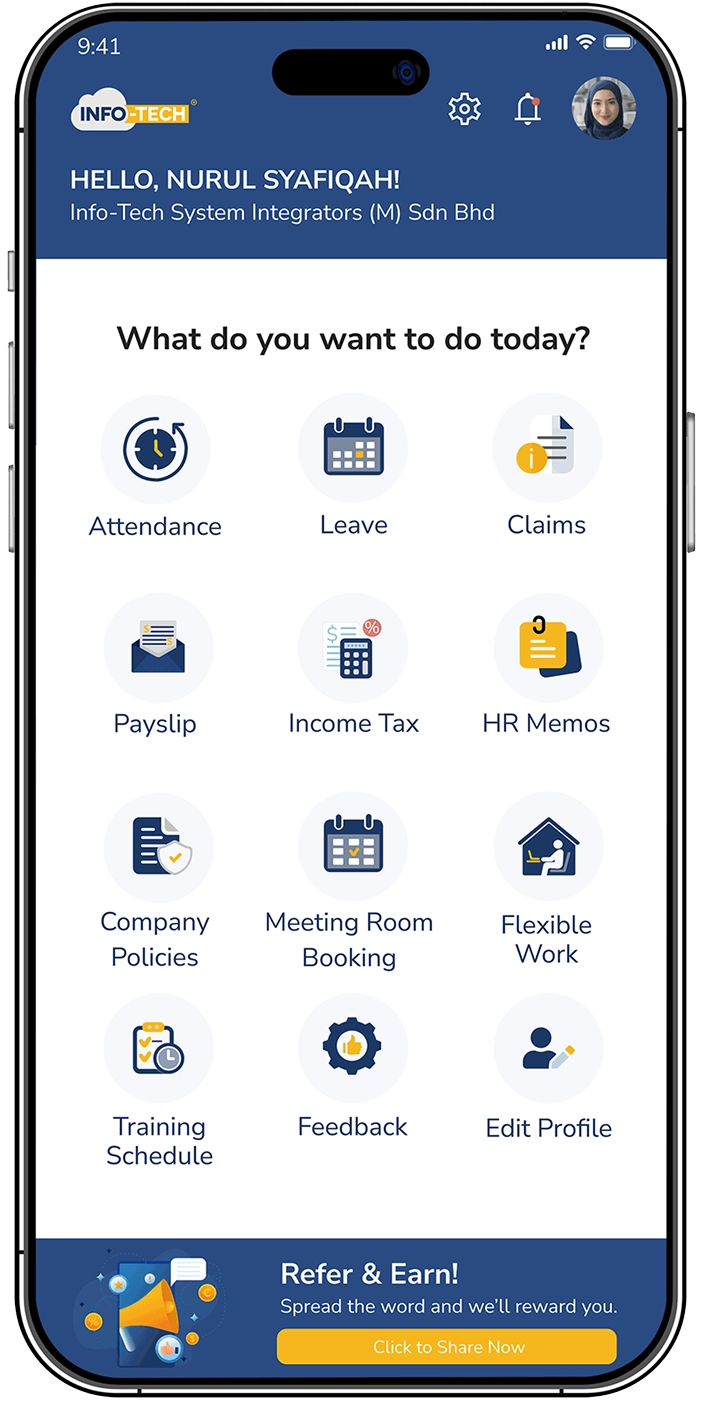

- Leave Management – Apply for leave online, approval & tracking

- Expense Claims – Submit, review and approve claims from any location

- Attendance Tracking – Time clock, GPS check-in, mobile punch-ins

- Custom Workflow Approvals – OT, purchase requests, and more with multi-level approval.

Check It Out Now – No Registration Required!

PCB Calculator FAQs

What's a Monthly PCB Calculator in Malaysia?

A Monthly PCB calculator in Malaysia figures out the Potongan Cukai Bulanan (PCB) that employers need to take out of an employees’ pay each month. It runs on LHDN-approved calculation taking into account monthly pay, EPF payments, tax breaks, marital status, and how many kids they have. This makes sure the payroll follows the current Income Tax Act rules.

How does a PCB Calculator Malaysia work in 2026?

A PCB calculator in Malaysia for 2026 uses the latest LHDN tax tables, relief thresholds, and EPF rates to figure out correct monthly tax deductions. Employers enter gross salary, benefits, bonuses, and employee info, and the calculator tweaks PCB amounts to match the newest tax rules and compliance standards for the 2026 assessment year.

How does an E-PCB Calculator differ from a Simple PCB Calculator?

An E-PCB calculator sticks to LHDN's official electronic PCB calculation method giving more precise results for tricky payroll setups. A simple PCB calculator gives a quick estimate based on base pay. While helpful for planning simple calculators might miss things like bonuses, benefits-in-kind, or detailed tax breaks.

Which PCB Calculator Table do companies use for monthly tax deductions?

Monthly PCB math relies on LHDN-issued PCB tables, which show tax cut amounts based on pay ranges and worker profiles. These tables get updates now and then to match changes in tax rates, breaks, and EPF payments, so it's key to use the newest PCB calculator table to avoid under- or over-deduction.

How does a PCB Calculator for Bonus work in Malaysia?

A PCB calculator for bonus calculates extra tax deductions when companies pay bonuses, commissions, or incentives. It turns the bonus into a yearly amount and adds it to the regular salary to find the right PCB. This helps spread employees' total tax bill throughout the year, so they don't face big tax changes later on.